- Home

- About us

- Reporting and accountability

- Surveys

- 2023 ASQA Provider and Course Owner Survey Results

- Detailed survey results 2022-23

Detailed survey results 2022-23

The information below represents providers view of ASQA’s performance against our corporate measures over the 2022-23 period.

2022-23 Strategic Objectives

Strategic Objective 1

Our regulatory approach promotes a culture of self-assurance and continuous improvement.

2022 | 76% agreed

2023 | 81% (+5%) agreed

KPI

1.1 ASQA’s regulatory tools and practices support providers to self-assure quality VET outcomes and continuously improve

Performance measure

1.1a) Percentage of providers that agree that our regulatory tools and practices support them to self-assure and continuously improve

Survey results

2022 | 76% agreed

2023 | 81% (+5%) agreed

KPI

1.2 Our published insights about risks and the outcomes of our risk treatments support providers to self-assure their own operations

Performance measure

1.2a) Percentage of providers that agree that our published insights about risks and the outcomes of our risk treatments support providers to self-assure their own operations

Survey results

2022 | 78% agreed

2023 | 75% agreed

Strategic Objective 2

ASQA's regulation is the best practice (i.e. integrated, risk-based and proportionate)

2022 | 65% agreed

2023 | 68% (+3%) agreed

KPI

2.2 Our education and communication with the sector supports regulatory outcomes

Performance measure

2.2b) Percentage of providers that report ASQA’s feedback is clear and supports an improved understanding of their performance

Survey results

2022 | 67% agreed

2023 | 75% agreed

Performance measure

2.2c) Percentage of applicants that report ASQA’s feedback is clear and supports an improved understanding of requirements

Survey results

2022 | 72% agreed

2023 | 75% agreed

Strategic Objective 3

Our regulatory approach is transparent and accountable

2022 | 60% agreed

2023 | 64% (+4%) agreed

Strategic Objective 4

ASQA engages and partners with providers and course owners constructively and with mutual respect.

2022 | 73% agreed

2023 | 73% (0%) agreed

Strategic Objective 5

We add value and are efficient, effective, and continuously improve.

2022 | 66% agreed

2023 | 67% (+1%) agreed

[1] “agree” and “Strongly agreed’ responses equate to total % agreement (% of all responses)

- Providers were asked to what extend do they agree with the statements relating to our Strategic Objectives and four Performance Measures in the survey.

- Survey results indicate an overall slight positive trend for all five Strategic Objectives. Strategic Objective 1 recorded the strongest improvement, up 5%.

- Performance Measures 1.1a and 1.2a met targets, while 2.2b and 2.2c did not meet the 75% target. Performance Measures 2.2b and 2.2c were assessed for the first time in 2022-23, we would consider this data a baseline, however the 2022-23 Corporate Plan established a target of 75%.

What providers are saying about self-assurance

Continuous improvement through self-assurance

Focus on quality

Self-assurance refers to how providers manage their operations to ensure a focus on quality, continuous improvement, and ongoing compliance with the Standards. It requires providers to have systems in place to critically examine their performance against the Standards and training outcomes, on an ongoing basis, to identify ways to continuously improve.

Improving with co-design

In 2021 and 2022, ASQA commissioned work to co-design a self-assurance model with the sector. The draft self-assurance model shared in 2022 is the result of reviews of existing research and practice and the practices of other regulators, and iteration of an initial model that embodies stakeholder consultation we conducted through in-depth interviews, online consultation, and focus groups.

Provider self-assurance

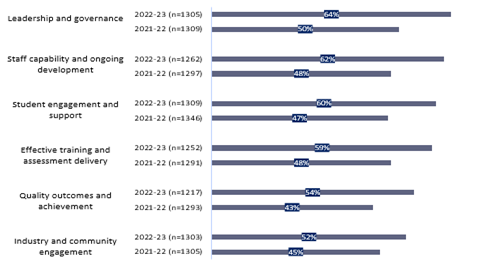

In 2022 and 2023, the survey asked providers to report their maturity against six key aspects of quality improvement through self-assurance: leadership and governance, staff capability and ongoing development, student engagement and support, effective training and assessment delivery, quality outcomes and achievement, and industry and community engagement.

The chart below shows the proportions of providers that consider themselves to be advanced or fully implemented in areas of quality improvement through self-assurance

Leadership and governance improvements

The proportion of providers who indicated their organisation was at a “fully implemented” or “advanced” status in this area recorded moderate to strong increases in all six implementation areas and showed significant increases in the number of self-assurance activities undertaken. The strongest increases were in the areas of leadership and governance (50>64%), staff capability and ongoing development (48>62%) and student engagement and support (47>55%).

Strong rise in risk management

The proportion of providers undertaking risk management activities rose from 66>77%, the proportion who clearly identified leaders who were accountable for quality and continuous improvement rose from 64>75, and the proportion where self-assurance activities are reported to senior leaders rose 52>65 per cent.

These improvements are likely to reflect the strength of ASQA’s work during 2021-22 and 2022-23 in developing a shared model for self-assurance.

Comments from respondents

- Providers and course-owners were also asked to provide open-ended comment on what areas ASQA is performing well. 14 key themes identified and four of these highest ratings were:

- Dissemination of communication and information’ (12%)

- good collaboration / consultation / engagement / guidance with providers and course owners (11%),

- quality of education resources and support (11%); and

- positive interactions with the ASQA team (11%).

- Regarding how ASQA could improve its performance, the majority of suggestions were similar to those provided in 2021-22. The most common suggestion related to ‘better quality or clearer communication between ASQA and providers’ (15%) and the ‘timeliness / efficiency of responses to guidance, information, or support requests’ (14%).

Share